.

Superannuation

From 1 July 2024, the amount you can contribute to super will increase.

The amount you can contribute to superannuation will increase on 1 July 2024 from $27,500 to $30,000 for concessional super contributions and from $110,000 to $120,000 for non-concessional contributions.

For those with the disposable income to contribute, superannuation can be very attractive with a 15% tax rate on concessional super contributions and potentially tax-free withdrawals when you retire. For business owners who might have had an exceptional year or sold their business, it's an opportunity to get more into super. However, the timing of contributions will be important to maximise outcomes.

If you know you will have a capital gains tax liability in a particular year, you may be able to use ‘catch up’ contributions to make a larger than usual contribution and use the tax deduction to help offset your capital gain tax bill. But, this strategy will only work if you meet the eligibility criteria to make catch up contributions and you lodge a Notice of intent to claim or vary a deduction for personal super contributions, with your super fund.

Using the bring forward rule

This topic has been touched on in previous articles but the ‘bring forward rule’ enables you to bring forward up to 2 years’ worth of future non-concessional contributions into the year you make the contribution – this is assuming your total superannuation balance enables you to make the contribution and you are under age 75.

If you utilise the bring forward rule before 30 June 2024, the maximum that can be contributed is $330,000. However, if you wait to trigger the bring forward until on or after 1 July 2024, then the maximum that can be contributed under this rule is $360,000.

‘Catch up’ contributions

If your super balance is below $500,000 prior to 30 June, and you want to quickly increase the amount you hold in super, you can utilise any unused concessional super contributions amounts from the last 5 years.

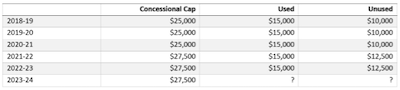

For example, a taxpayer has only been using $15,000 of the concessional super cap for the last few years. The super balance at 30 June 2023 was $300,000, so this person is well within the limit to make catch up contributions.

This person could access their $27,500 concessional cap for 2023-24 plus the unused $55,000 from the prior 5 financial years.

However, if the unused amount from 2018-19 is not used by 30 June 2024, the $10,000 will no longer be available.

Taxation

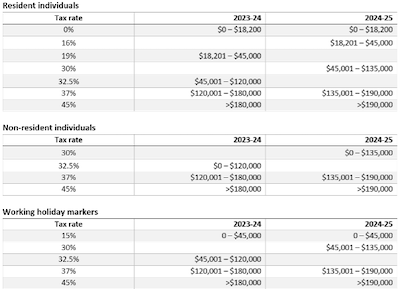

As we all know, the revised stage 3 tax cuts have passed Parliament and will come into effect on 1 July 2024. The following table outlines what the rates currently are and what they will be from the 2025 financial year.

Salary sacrifice agreements should be checked before the new tax rates come into effect to ensure they will continue to produce the result you are after.

Be sure to contact us if you have any concerns or questions.

20th-April-2024 |